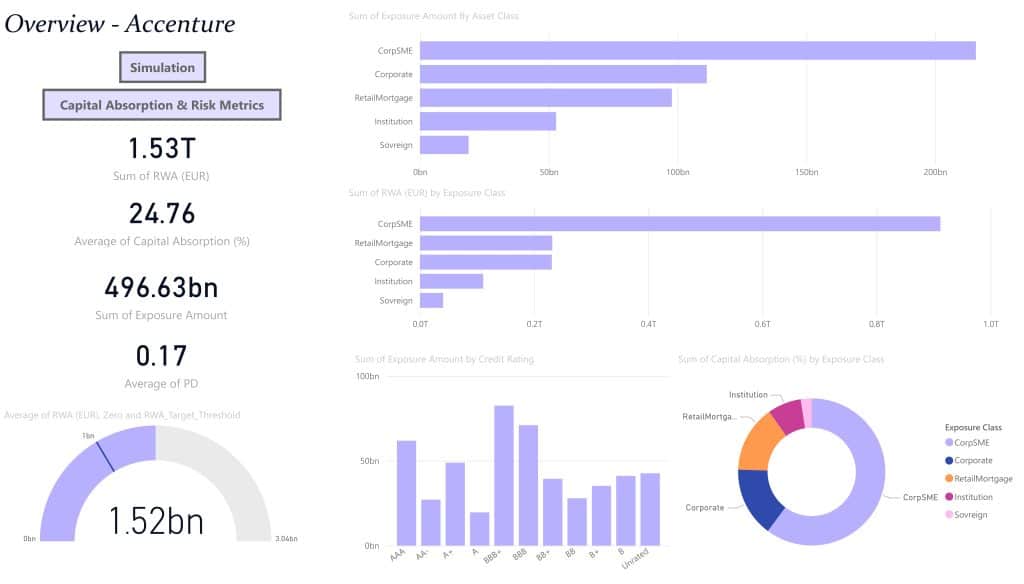

Banks are under pressure to optimize capital usage while complying with evolving regulatory standards—most notably Basel IV. In partnership with Accenture, I designed and developed an executive-facing Power BI dashboard that equips financial institutions to explore their portfolios through the lens of Basel IV capital requirements.

1. The Challenge

Banks must constantly navigate a shifting regulatory landscape. Under Basel IV, institutions face more granular, standardized credit risk capital requirements, making it more difficult to optimize portfolios and manage capital efficiently. Our challenge was to build an analytical platform that empowers executives—particularly Chief Risk Officers and Chief Financial Officers—with tools to understand, simulate, and strategically respond to these capital demands.

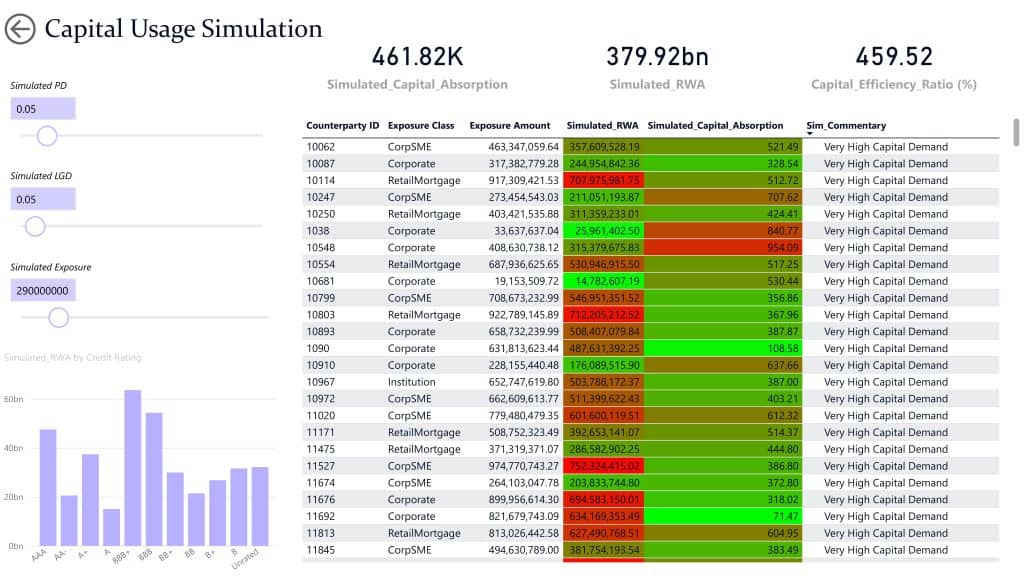

Our mission was to create a highly interactive, data-rich dashboard that would let bank executives visualize their current risk exposure, run scenario simulations, and identify portfolio inefficiencies

2. The Approach

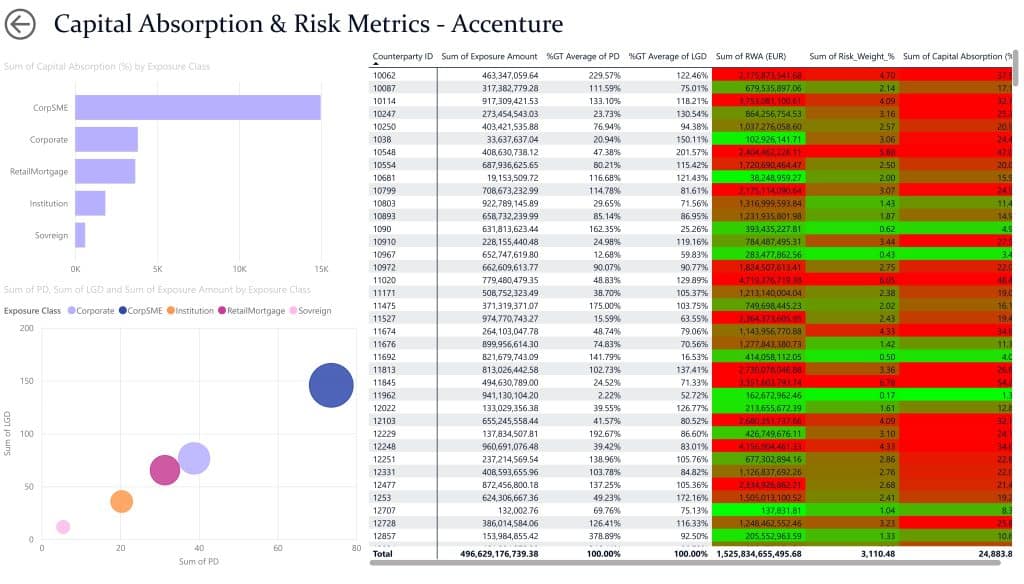

We began by deconstructing the Basel IV framework—centering on key drivers like Risk-Weighted Assets (RWA), Probability of Default (PD), Loss Given Default (LGD), and Exposure at Default (EAD). From there, we launched a multi-layered design sprint to translate regulatory complexity into actionable visual intelligence.

Our solution integrates:

A multi-page Power BI dashboard to simulate real-time capital impact under varying credit scenarios

A hierarchical KPI system to contextualize capital efficiency across portfolios

Interactive controls for scenario analysis, sensitivity testing, and executive what-if planning

The project demanded advanced DAX modeling, optimized data structures, and thoughtful color logic to enable rapid, intuitive insights. Each visual—whether a high-level KPI or a segment-level chart—was purpose-built to expose the nuances of capital risk and efficiency in a clear, decision-ready format.

3. The Result

The final product is a robust, executive-ready analytics platform that transforms Basel IV requirements into actionable insights. Designed in collaboration with Accenture, the solution delivers:

A fully interactive Power BI dashboard with three core pages: overview, risk metrics, and simulation

Real-time scenario modeling using PD, LGD, and Exposure sliders to reflect capital sensitivity

Intuitive visual hierarchies and KPI systems that prioritize clarity for decision-makers

Dynamic tools for identifying risk concentrations and evaluating capital absorption by segment

This dashboard doesn’t just report regulatory metrics—it enables leadership to actively manage capital demand, improve portfolio strategy, and prepare confidently for Basel IV compliance.